Collection of Careshield life premiums ~ Premium will increase according to your age so as to cater for a higher payout from Careshield Life. CareShield Life annual premiums start from S 206 for men and S 253 for women for 30-year-olds in 2020.

as we know it lately has been hunted by consumers around us, perhaps one of you. Individuals are now accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the name of the article I will discuss about Careshield Life Premiums If you are born in 1945 or earlier contact the Healthcare Hotline at 1800-222-3399 for your premiums.

Careshield life premiums

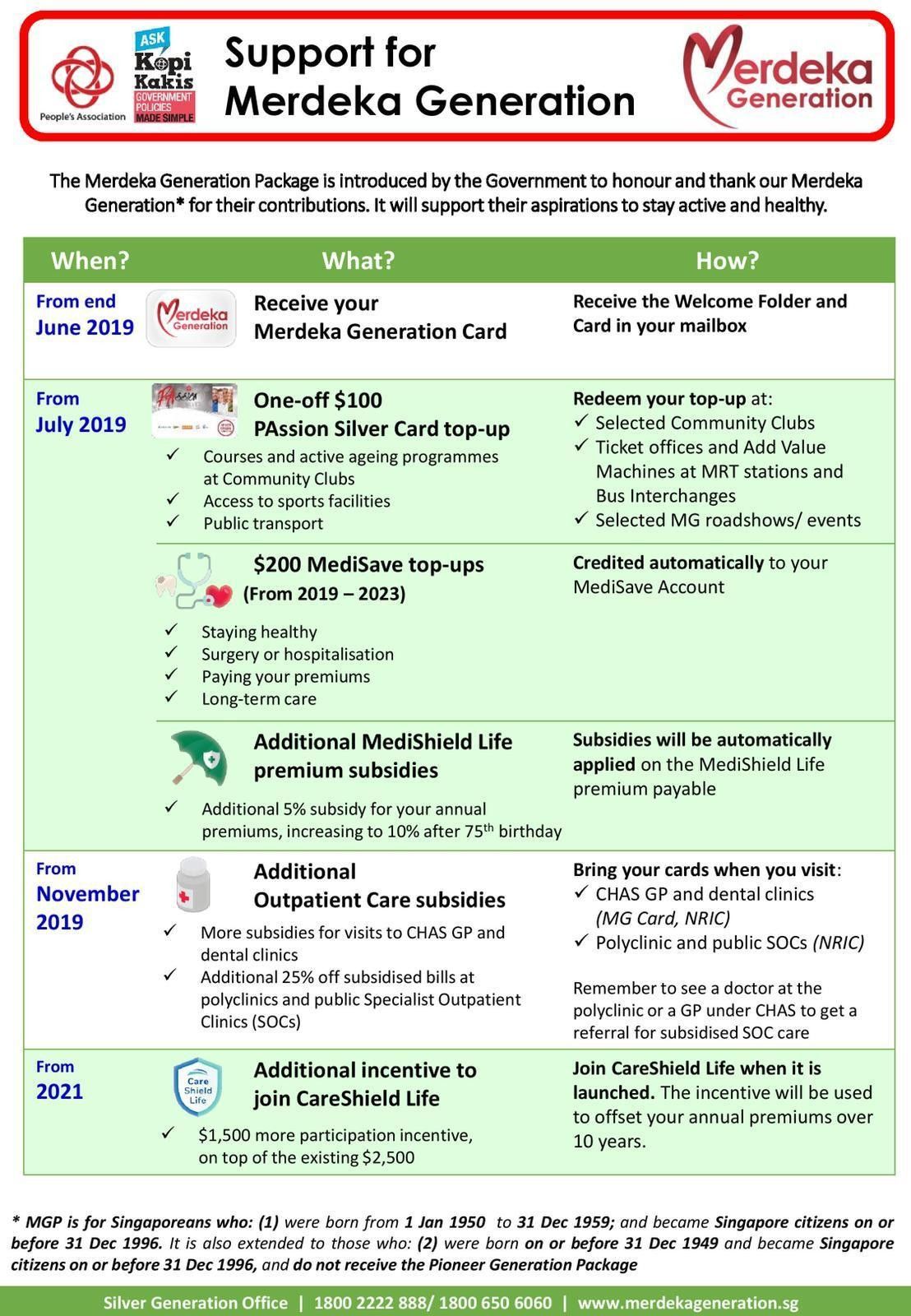

Collection of Careshield life premiums ~ 28 rows Your premium amount is determined at the age of entry and does not increase with age. 28 rows Your premium amount is determined at the age of entry and does not increase with age. 28 rows Your premium amount is determined at the age of entry and does not increase with age. 28 rows Your premium amount is determined at the age of entry and does not increase with age. The annual premium starts at 206 for men but 253 for women. The annual premium starts at 206 for men but 253 for women. The annual premium starts at 206 for men but 253 for women. The annual premium starts at 206 for men but 253 for women. Additional participation incentives of 1500 for Merdeka and Pioneer Generation citizens if they join CareShield Life by 31 December 2023. Additional participation incentives of 1500 for Merdeka and Pioneer Generation citizens if they join CareShield Life by 31 December 2023. Additional participation incentives of 1500 for Merdeka and Pioneer Generation citizens if they join CareShield Life by 31 December 2023. Additional participation incentives of 1500 for Merdeka and Pioneer Generation citizens if they join CareShield Life by 31 December 2023.

The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020. For more information on. For more information on. For more information on. For more information on. This Pin Was Discovered By Semida Seiche Discover And Save Your Own Pins On Pinterest Fashion Face Mask Rhinestone Face Mask Diy Face Mask. This Pin Was Discovered By Semida Seiche Discover And Save Your Own Pins On Pinterest Fashion Face Mask Rhinestone Face Mask Diy Face Mask. This Pin Was Discovered By Semida Seiche Discover And Save Your Own Pins On Pinterest Fashion Face Mask Rhinestone Face Mask Diy Face Mask. This Pin Was Discovered By Semida Seiche Discover And Save Your Own Pins On Pinterest Fashion Face Mask Rhinestone Face Mask Diy Face Mask.

If you are born in 1991 or later your premiums will be made available when you turn 30 and you may check your premiums here. If you are born in 1991 or later your premiums will be made available when you turn 30 and you may check your premiums here. If you are born in 1991 or later your premiums will be made available when you turn 30 and you may check your premiums here. If you are born in 1991 or later your premiums will be made available when you turn 30 and you may check your premiums here. Unlike ElderShield CareShield Life has premium support to ensure no one loses coverage due to an inability to pay it added. Unlike ElderShield CareShield Life has premium support to ensure no one loses coverage due to an inability to pay it added. Unlike ElderShield CareShield Life has premium support to ensure no one loses coverage due to an inability to pay it added. Unlike ElderShield CareShield Life has premium support to ensure no one loses coverage due to an inability to pay it added. They increase every year due to the payouts also increasing. They increase every year due to the payouts also increasing. They increase every year due to the payouts also increasing. They increase every year due to the payouts also increasing.

There are currently more. There are currently more. There are currently more. There are currently more. If Only Singaporeans Stopped To Think Careshield Life Singapore S National Disability Insurance Will Be Launched On 1 October 2020. If Only Singaporeans Stopped To Think Careshield Life Singapore S National Disability Insurance Will Be Launched On 1 October 2020. If Only Singaporeans Stopped To Think Careshield Life Singapore S National Disability Insurance Will Be Launched On 1 October 2020. If Only Singaporeans Stopped To Think Careshield Life Singapore S National Disability Insurance Will Be Launched On 1 October 2020. One gripe about the scheme which will be compulsory for those aged between 30 and 40 by 2020 is that women will pay higher premiums. One gripe about the scheme which will be compulsory for those aged between 30 and 40 by 2020 is that women will pay higher premiums. One gripe about the scheme which will be compulsory for those aged between 30 and 40 by 2020 is that women will pay higher premiums. One gripe about the scheme which will be compulsory for those aged between 30 and 40 by 2020 is that women will pay higher premiums.

The New Careshield Life Sg One Step. The New Careshield Life Sg One Step. The New Careshield Life Sg One Step. The New Careshield Life Sg One Step. This way we wont need to pay for premiums during our retirement years but. This way we wont need to pay for premiums during our retirement years but. This way we wont need to pay for premiums during our retirement years but. This way we wont need to pay for premiums during our retirement years but. This figure is pretty close to the average. This figure is pretty close to the average. This figure is pretty close to the average. This figure is pretty close to the average.

With the new implementation of CareShield Life the monthly payout will be 600. With the new implementation of CareShield Life the monthly payout will be 600. With the new implementation of CareShield Life the monthly payout will be 600. With the new implementation of CareShield Life the monthly payout will be 600. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. ElderShield400 and ElderShield300 Premiums. ElderShield400 and ElderShield300 Premiums. ElderShield400 and ElderShield300 Premiums. ElderShield400 and ElderShield300 Premiums.

Every calendar year you can only use a maximum of 600 from MediSave per person insured and the balance premiums would then need to be paid for in cash. Every calendar year you can only use a maximum of 600 from MediSave per person insured and the balance premiums would then need to be paid for in cash. Every calendar year you can only use a maximum of 600 from MediSave per person insured and the balance premiums would then need to be paid for in cash. Every calendar year you can only use a maximum of 600 from MediSave per person insured and the balance premiums would then need to be paid for in cash. CareShield Life is a long-term care insurance scheme that provides basic financial support should Singaporeans become severely disabled especially during old age and need personal and medical care for a prolonged duration ie. CareShield Life is a long-term care insurance scheme that provides basic financial support should Singaporeans become severely disabled especially during old age and need personal and medical care for a prolonged duration ie. CareShield Life is a long-term care insurance scheme that provides basic financial support should Singaporeans become severely disabled especially during old age and need personal and medical care for a prolonged duration ie. CareShield Life is a long-term care insurance scheme that provides basic financial support should Singaporeans become severely disabled especially during old age and need personal and medical care for a prolonged duration ie. CareShield Life premiums are pre-funded with premiums paid during your working years. CareShield Life premiums are pre-funded with premiums paid during your working years. CareShield Life premiums are pre-funded with premiums paid during your working years. CareShield Life premiums are pre-funded with premiums paid during your working years.

In the unfortunate event where you make a successful claim your monthly payout amount remains fixed and youll receive payouts for as long as you are severely disabled. In the unfortunate event where you make a successful claim your monthly payout amount remains fixed and youll receive payouts for as long as you are severely disabled. In the unfortunate event where you make a successful claim your monthly payout amount remains fixed and youll receive payouts for as long as you are severely disabled. In the unfortunate event where you make a successful claim your monthly payout amount remains fixed and youll receive payouts for as long as you are severely disabled. Up to 100000 in coverage. Up to 100000 in coverage. Up to 100000 in coverage. Up to 100000 in coverage. CareShield Life by 31 December 2023 to encourage those born in 1979 or earlier to join CareShield Life. CareShield Life by 31 December 2023 to encourage those born in 1979 or earlier to join CareShield Life. CareShield Life by 31 December 2023 to encourage those born in 1979 or earlier to join CareShield Life. CareShield Life by 31 December 2023 to encourage those born in 1979 or earlier to join CareShield Life.

Illustration Of Approximate Lifetime Cost Of CareShield Life Premiums. Illustration Of Approximate Lifetime Cost Of CareShield Life Premiums. Illustration Of Approximate Lifetime Cost Of CareShield Life Premiums. Illustration Of Approximate Lifetime Cost Of CareShield Life Premiums. Better yet CareShield Life supplements premiums are eligible for MediSave deduction capped at S600 a year. Better yet CareShield Life supplements premiums are eligible for MediSave deduction capped at S600 a year. Better yet CareShield Life supplements premiums are eligible for MediSave deduction capped at S600 a year. Better yet CareShield Life supplements premiums are eligible for MediSave deduction capped at S600 a year. The government also manages a pool of funds within your generation to cover its current and future claims. The government also manages a pool of funds within your generation to cover its current and future claims. The government also manages a pool of funds within your generation to cover its current and future claims. The government also manages a pool of funds within your generation to cover its current and future claims.

Click the following links to find out more about CareShield Life features and how the Government will ensure that CareShield Life premiums are affordable for you. Click the following links to find out more about CareShield Life features and how the Government will ensure that CareShield Life premiums are affordable for you. Click the following links to find out more about CareShield Life features and how the Government will ensure that CareShield Life premiums are affordable for you. Click the following links to find out more about CareShield Life features and how the Government will ensure that CareShield Life premiums are affordable for you. Healthcare and the insurance that pays for it have long been hot topics here so it is no surprise that CareShield Life has sparked much debate. Healthcare and the insurance that pays for it have long been hot topics here so it is no surprise that CareShield Life has sparked much debate. Healthcare and the insurance that pays for it have long been hot topics here so it is no surprise that CareShield Life has sparked much debate. Healthcare and the insurance that pays for it have long been hot topics here so it is no surprise that CareShield Life has sparked much debate. Those who live in residences with an AV between 13001 and 21000 will receive 10 percentage points less than these subsidy rates. Those who live in residences with an AV between 13001 and 21000 will receive 10 percentage points less than these subsidy rates. Those who live in residences with an AV between 13001 and 21000 will receive 10 percentage points less than these subsidy rates. Those who live in residences with an AV between 13001 and 21000 will receive 10 percentage points less than these subsidy rates.

How much are CareShield Life premiums. How much are CareShield Life premiums. How much are CareShield Life premiums. How much are CareShield Life premiums. CareShield Life premiums can be paid using MediSave. CareShield Life premiums can be paid using MediSave. CareShield Life premiums can be paid using MediSave. CareShield Life premiums can be paid using MediSave. If you are auto-enrolled you can opt out of CareShield Life by 31 Dec 2023 if you do not wish to join the scheme and your CareShield Life premiums will be refunded. If you are auto-enrolled you can opt out of CareShield Life by 31 Dec 2023 if you do not wish to join the scheme and your CareShield Life premiums will be refunded. If you are auto-enrolled you can opt out of CareShield Life by 31 Dec 2023 if you do not wish to join the scheme and your CareShield Life premiums will be refunded. If you are auto-enrolled you can opt out of CareShield Life by 31 Dec 2023 if you do not wish to join the scheme and your CareShield Life premiums will be refunded.

How Much Careshield Life Premiums Will You Be Paying And Subsidies You Ll Receive. How Much Careshield Life Premiums Will You Be Paying And Subsidies You Ll Receive. How Much Careshield Life Premiums Will You Be Paying And Subsidies You Ll Receive. How Much Careshield Life Premiums Will You Be Paying And Subsidies You Ll Receive. Assuming the premiums go up consistently at 2 each year heres how much the cohort of 30-year. Assuming the premiums go up consistently at 2 each year heres how much the cohort of 30-year. Assuming the premiums go up consistently at 2 each year heres how much the cohort of 30-year. Assuming the premiums go up consistently at 2 each year heres how much the cohort of 30-year. Premiums are payable annually until the policy anniversary after your 65 th birthday or when you make a successful claim whichever is earlier. Premiums are payable annually until the policy anniversary after your 65 th birthday or when you make a successful claim whichever is earlier. Premiums are payable annually until the policy anniversary after your 65 th birthday or when you make a successful claim whichever is earlier. Premiums are payable annually until the policy anniversary after your 65 th birthday or when you make a successful claim whichever is earlier.

The Government will provide means-tested premium subsidies of up to 30 to improve the affordability of your CareShield Life premiums. The Government will provide means-tested premium subsidies of up to 30 to improve the affordability of your CareShield Life premiums. The Government will provide means-tested premium subsidies of up to 30 to improve the affordability of your CareShield Life premiums. The Government will provide means-tested premium subsidies of up to 30 to improve the affordability of your CareShield Life premiums. Additional premiums for a CareShield Life Supplement plan can be paid either in cash or using funds from your MediSave account or that of your family members spouse parents children siblings or grandchildren. Additional premiums for a CareShield Life Supplement plan can be paid either in cash or using funds from your MediSave account or that of your family members spouse parents children siblings or grandchildren. Additional premiums for a CareShield Life Supplement plan can be paid either in cash or using funds from your MediSave account or that of your family members spouse parents children siblings or grandchildren. Additional premiums for a CareShield Life Supplement plan can be paid either in cash or using funds from your MediSave account or that of your family members spouse parents children siblings or grandchildren. Those born in 1979 or earlier do not need to take any action now. Those born in 1979 or earlier do not need to take any action now. Those born in 1979 or earlier do not need to take any action now. Those born in 1979 or earlier do not need to take any action now.

Supplement products are strictly run by the private insurers and the premiums that have already been paid for Supplements will not be. Supplement products are strictly run by the private insurers and the premiums that have already been paid for Supplements will not be. Supplement products are strictly run by the private insurers and the premiums that have already been paid for Supplements will not be. Supplement products are strictly run by the private insurers and the premiums that have already been paid for Supplements will not be. CareShield Life the long-term care insurance scheme for basic financial protection against severe disability is mandatory for all Singaporeans born in 1980 or later. CareShield Life the long-term care insurance scheme for basic financial protection against severe disability is mandatory for all Singaporeans born in 1980 or later. CareShield Life the long-term care insurance scheme for basic financial protection against severe disability is mandatory for all Singaporeans born in 1980 or later. CareShield Life the long-term care insurance scheme for basic financial protection against severe disability is mandatory for all Singaporeans born in 1980 or later. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020.

What is CareShield Life. What is CareShield Life. What is CareShield Life. What is CareShield Life. These supplements may also offer more peace of mind than your basic CareShield Life plan through perks such as dependant and death benefits that provide financial support to your loved ones as well. These supplements may also offer more peace of mind than your basic CareShield Life plan through perks such as dependant and death benefits that provide financial support to your loved ones as well. These supplements may also offer more peace of mind than your basic CareShield Life plan through perks such as dependant and death benefits that provide financial support to your loved ones as well. These supplements may also offer more peace of mind than your basic CareShield Life plan through perks such as dependant and death benefits that provide financial support to your loved ones as well. For those aged 30 in 2020 premiums start at 206 for men and 253 for women. For those aged 30 in 2020 premiums start at 206 for men and 253 for women. For those aged 30 in 2020 premiums start at 206 for men and 253 for women. For those aged 30 in 2020 premiums start at 206 for men and 253 for women.

Why do we need CareShield Life. Why do we need CareShield Life. Why do we need CareShield Life. Why do we need CareShield Life. CareShield Life - which offers better and longer payouts than ElderShield which has been around since 2002 - is mandatory for all Singaporeans born in 1980 or later. CareShield Life - which offers better and longer payouts than ElderShield which has been around since 2002 - is mandatory for all Singaporeans born in 1980 or later. CareShield Life - which offers better and longer payouts than ElderShield which has been around since 2002 - is mandatory for all Singaporeans born in 1980 or later. CareShield Life - which offers better and longer payouts than ElderShield which has been around since 2002 - is mandatory for all Singaporeans born in 1980 or later. Best Careshield Life Supplements In Singapore 2021 Homage. Best Careshield Life Supplements In Singapore 2021 Homage. Best Careshield Life Supplements In Singapore 2021 Homage. Best Careshield Life Supplements In Singapore 2021 Homage.

CareShield Life was launched on 1 October 2020 for all Singapore Citizens or Permanent Residents born in 1980 or later. CareShield Life was launched on 1 October 2020 for all Singapore Citizens or Permanent Residents born in 1980 or later. CareShield Life was launched on 1 October 2020 for all Singapore Citizens or Permanent Residents born in 1980 or later. CareShield Life was launched on 1 October 2020 for all Singapore Citizens or Permanent Residents born in 1980 or later. Your Careshield Life premium is 100 payable by Medisave and the premium term is until age 67. Your Careshield Life premium is 100 payable by Medisave and the premium term is until age 67. Your Careshield Life premium is 100 payable by Medisave and the premium term is until age 67. Your Careshield Life premium is 100 payable by Medisave and the premium term is until age 67. 1 Subsidy rates are applicable to Singapore Citizens who live in residences with an Annual Value AV of 13000 or less. 1 Subsidy rates are applicable to Singapore Citizens who live in residences with an Annual Value AV of 13000 or less. 1 Subsidy rates are applicable to Singapore Citizens who live in residences with an Annual Value AV of 13000 or less. 1 Subsidy rates are applicable to Singapore Citizens who live in residences with an Annual Value AV of 13000 or less.

These cohorts are. These cohorts are. These cohorts are. These cohorts are. Additional Premium Support for. Additional Premium Support for. Additional Premium Support for. Additional Premium Support for. How to check your ElderShield Coverage. How to check your ElderShield Coverage. How to check your ElderShield Coverage. How to check your ElderShield Coverage.

Better yet CareShield Life supplements premiums are eligible for MediSave deduction capped at S600 a year. Better yet CareShield Life supplements premiums are eligible for MediSave deduction capped at S600 a year. Better yet CareShield Life supplements premiums are eligible for MediSave deduction capped at S600 a year. Better yet CareShield Life supplements premiums are eligible for MediSave deduction capped at S600 a year. More information on the auto-enrolment premiums subsidies and support package will be provided when ready. More information on the auto-enrolment premiums subsidies and support package will be provided when ready. More information on the auto-enrolment premiums subsidies and support package will be provided when ready. More information on the auto-enrolment premiums subsidies and support package will be provided when ready. The plan offers a monthly payout in the event of severe disability providing basic financial support for long-term. The plan offers a monthly payout in the event of severe disability providing basic financial support for long-term. The plan offers a monthly payout in the event of severe disability providing basic financial support for long-term. The plan offers a monthly payout in the event of severe disability providing basic financial support for long-term.

The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. There are no restrictions on the number of supplement policies one can be covered. There are no restrictions on the number of supplement policies one can be covered. There are no restrictions on the number of supplement policies one can be covered. There are no restrictions on the number of supplement policies one can be covered. Overview Of CareShield Life Supplement Plans Available In The Market. Overview Of CareShield Life Supplement Plans Available In The Market. Overview Of CareShield Life Supplement Plans Available In The Market. Overview Of CareShield Life Supplement Plans Available In The Market.

Hands Supporting Heart Problem Disease Campaign Free Image By Rawpixel Com Katie In 2021 Heart Problems Medical App Medical Wallpaper

Source Image @ www.pinterest.com

Careshield life premiums | Hands Supporting Heart Problem Disease Campaign Free Image By Rawpixel Com Katie In 2021 Heart Problems Medical App Medical Wallpaper

Collection of Careshield life premiums ~ 28 rows Your premium amount is determined at the age of entry and does not increase with age. 28 rows Your premium amount is determined at the age of entry and does not increase with age. 28 rows Your premium amount is determined at the age of entry and does not increase with age. The annual premium starts at 206 for men but 253 for women. The annual premium starts at 206 for men but 253 for women. The annual premium starts at 206 for men but 253 for women. Additional participation incentives of 1500 for Merdeka and Pioneer Generation citizens if they join CareShield Life by 31 December 2023. Additional participation incentives of 1500 for Merdeka and Pioneer Generation citizens if they join CareShield Life by 31 December 2023. Additional participation incentives of 1500 for Merdeka and Pioneer Generation citizens if they join CareShield Life by 31 December 2023.

The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020. For more information on. For more information on. For more information on. This Pin Was Discovered By Semida Seiche Discover And Save Your Own Pins On Pinterest Fashion Face Mask Rhinestone Face Mask Diy Face Mask. This Pin Was Discovered By Semida Seiche Discover And Save Your Own Pins On Pinterest Fashion Face Mask Rhinestone Face Mask Diy Face Mask. This Pin Was Discovered By Semida Seiche Discover And Save Your Own Pins On Pinterest Fashion Face Mask Rhinestone Face Mask Diy Face Mask.

If you are born in 1991 or later your premiums will be made available when you turn 30 and you may check your premiums here. If you are born in 1991 or later your premiums will be made available when you turn 30 and you may check your premiums here. If you are born in 1991 or later your premiums will be made available when you turn 30 and you may check your premiums here. Unlike ElderShield CareShield Life has premium support to ensure no one loses coverage due to an inability to pay it added. Unlike ElderShield CareShield Life has premium support to ensure no one loses coverage due to an inability to pay it added. Unlike ElderShield CareShield Life has premium support to ensure no one loses coverage due to an inability to pay it added. They increase every year due to the payouts also increasing. They increase every year due to the payouts also increasing. They increase every year due to the payouts also increasing.

There are currently more. There are currently more. There are currently more. If Only Singaporeans Stopped To Think Careshield Life Singapore S National Disability Insurance Will Be Launched On 1 October 2020. If Only Singaporeans Stopped To Think Careshield Life Singapore S National Disability Insurance Will Be Launched On 1 October 2020. If Only Singaporeans Stopped To Think Careshield Life Singapore S National Disability Insurance Will Be Launched On 1 October 2020. One gripe about the scheme which will be compulsory for those aged between 30 and 40 by 2020 is that women will pay higher premiums. One gripe about the scheme which will be compulsory for those aged between 30 and 40 by 2020 is that women will pay higher premiums. One gripe about the scheme which will be compulsory for those aged between 30 and 40 by 2020 is that women will pay higher premiums.

The New Careshield Life Sg One Step. The New Careshield Life Sg One Step. The New Careshield Life Sg One Step. This way we wont need to pay for premiums during our retirement years but. This way we wont need to pay for premiums during our retirement years but. This way we wont need to pay for premiums during our retirement years but. This figure is pretty close to the average. This figure is pretty close to the average. This figure is pretty close to the average.

With the new implementation of CareShield Life the monthly payout will be 600. With the new implementation of CareShield Life the monthly payout will be 600. With the new implementation of CareShield Life the monthly payout will be 600. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. ElderShield400 and ElderShield300 Premiums. ElderShield400 and ElderShield300 Premiums. ElderShield400 and ElderShield300 Premiums.

Every calendar year you can only use a maximum of 600 from MediSave per person insured and the balance premiums would then need to be paid for in cash. Every calendar year you can only use a maximum of 600 from MediSave per person insured and the balance premiums would then need to be paid for in cash. Every calendar year you can only use a maximum of 600 from MediSave per person insured and the balance premiums would then need to be paid for in cash. CareShield Life is a long-term care insurance scheme that provides basic financial support should Singaporeans become severely disabled especially during old age and need personal and medical care for a prolonged duration ie. CareShield Life is a long-term care insurance scheme that provides basic financial support should Singaporeans become severely disabled especially during old age and need personal and medical care for a prolonged duration ie. CareShield Life is a long-term care insurance scheme that provides basic financial support should Singaporeans become severely disabled especially during old age and need personal and medical care for a prolonged duration ie. CareShield Life premiums are pre-funded with premiums paid during your working years. CareShield Life premiums are pre-funded with premiums paid during your working years. CareShield Life premiums are pre-funded with premiums paid during your working years.

In the unfortunate event where you make a successful claim your monthly payout amount remains fixed and youll receive payouts for as long as you are severely disabled. In the unfortunate event where you make a successful claim your monthly payout amount remains fixed and youll receive payouts for as long as you are severely disabled. In the unfortunate event where you make a successful claim your monthly payout amount remains fixed and youll receive payouts for as long as you are severely disabled. Up to 100000 in coverage. Up to 100000 in coverage. Up to 100000 in coverage. CareShield Life by 31 December 2023 to encourage those born in 1979 or earlier to join CareShield Life. CareShield Life by 31 December 2023 to encourage those born in 1979 or earlier to join CareShield Life. CareShield Life by 31 December 2023 to encourage those born in 1979 or earlier to join CareShield Life.

Illustration Of Approximate Lifetime Cost Of CareShield Life Premiums. Illustration Of Approximate Lifetime Cost Of CareShield Life Premiums. Illustration Of Approximate Lifetime Cost Of CareShield Life Premiums. Better yet CareShield Life supplements premiums are eligible for MediSave deduction capped at S600 a year. Better yet CareShield Life supplements premiums are eligible for MediSave deduction capped at S600 a year. Better yet CareShield Life supplements premiums are eligible for MediSave deduction capped at S600 a year. The government also manages a pool of funds within your generation to cover its current and future claims. The government also manages a pool of funds within your generation to cover its current and future claims. The government also manages a pool of funds within your generation to cover its current and future claims.

Click the following links to find out more about CareShield Life features and how the Government will ensure that CareShield Life premiums are affordable for you. Click the following links to find out more about CareShield Life features and how the Government will ensure that CareShield Life premiums are affordable for you. Click the following links to find out more about CareShield Life features and how the Government will ensure that CareShield Life premiums are affordable for you. Healthcare and the insurance that pays for it have long been hot topics here so it is no surprise that CareShield Life has sparked much debate. Healthcare and the insurance that pays for it have long been hot topics here so it is no surprise that CareShield Life has sparked much debate. Healthcare and the insurance that pays for it have long been hot topics here so it is no surprise that CareShield Life has sparked much debate. Those who live in residences with an AV between 13001 and 21000 will receive 10 percentage points less than these subsidy rates. Those who live in residences with an AV between 13001 and 21000 will receive 10 percentage points less than these subsidy rates. Those who live in residences with an AV between 13001 and 21000 will receive 10 percentage points less than these subsidy rates.

How much are CareShield Life premiums. How much are CareShield Life premiums. How much are CareShield Life premiums. CareShield Life premiums can be paid using MediSave. CareShield Life premiums can be paid using MediSave. CareShield Life premiums can be paid using MediSave. If you are auto-enrolled you can opt out of CareShield Life by 31 Dec 2023 if you do not wish to join the scheme and your CareShield Life premiums will be refunded. If you are auto-enrolled you can opt out of CareShield Life by 31 Dec 2023 if you do not wish to join the scheme and your CareShield Life premiums will be refunded. If you are auto-enrolled you can opt out of CareShield Life by 31 Dec 2023 if you do not wish to join the scheme and your CareShield Life premiums will be refunded.

How Much Careshield Life Premiums Will You Be Paying And Subsidies You Ll Receive. How Much Careshield Life Premiums Will You Be Paying And Subsidies You Ll Receive. How Much Careshield Life Premiums Will You Be Paying And Subsidies You Ll Receive. Assuming the premiums go up consistently at 2 each year heres how much the cohort of 30-year. Assuming the premiums go up consistently at 2 each year heres how much the cohort of 30-year. Assuming the premiums go up consistently at 2 each year heres how much the cohort of 30-year. Premiums are payable annually until the policy anniversary after your 65 th birthday or when you make a successful claim whichever is earlier. Premiums are payable annually until the policy anniversary after your 65 th birthday or when you make a successful claim whichever is earlier. Premiums are payable annually until the policy anniversary after your 65 th birthday or when you make a successful claim whichever is earlier.

The Government will provide means-tested premium subsidies of up to 30 to improve the affordability of your CareShield Life premiums. The Government will provide means-tested premium subsidies of up to 30 to improve the affordability of your CareShield Life premiums. The Government will provide means-tested premium subsidies of up to 30 to improve the affordability of your CareShield Life premiums. Additional premiums for a CareShield Life Supplement plan can be paid either in cash or using funds from your MediSave account or that of your family members spouse parents children siblings or grandchildren. Additional premiums for a CareShield Life Supplement plan can be paid either in cash or using funds from your MediSave account or that of your family members spouse parents children siblings or grandchildren. Additional premiums for a CareShield Life Supplement plan can be paid either in cash or using funds from your MediSave account or that of your family members spouse parents children siblings or grandchildren. Those born in 1979 or earlier do not need to take any action now. Those born in 1979 or earlier do not need to take any action now. Those born in 1979 or earlier do not need to take any action now.

Supplement products are strictly run by the private insurers and the premiums that have already been paid for Supplements will not be. Supplement products are strictly run by the private insurers and the premiums that have already been paid for Supplements will not be. Supplement products are strictly run by the private insurers and the premiums that have already been paid for Supplements will not be. CareShield Life the long-term care insurance scheme for basic financial protection against severe disability is mandatory for all Singaporeans born in 1980 or later. CareShield Life the long-term care insurance scheme for basic financial protection against severe disability is mandatory for all Singaporeans born in 1980 or later. CareShield Life the long-term care insurance scheme for basic financial protection against severe disability is mandatory for all Singaporeans born in 1980 or later. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020.

What is CareShield Life. What is CareShield Life. What is CareShield Life. These supplements may also offer more peace of mind than your basic CareShield Life plan through perks such as dependant and death benefits that provide financial support to your loved ones as well. These supplements may also offer more peace of mind than your basic CareShield Life plan through perks such as dependant and death benefits that provide financial support to your loved ones as well. These supplements may also offer more peace of mind than your basic CareShield Life plan through perks such as dependant and death benefits that provide financial support to your loved ones as well. For those aged 30 in 2020 premiums start at 206 for men and 253 for women. For those aged 30 in 2020 premiums start at 206 for men and 253 for women. For those aged 30 in 2020 premiums start at 206 for men and 253 for women.

Why do we need CareShield Life. Why do we need CareShield Life. Why do we need CareShield Life. CareShield Life - which offers better and longer payouts than ElderShield which has been around since 2002 - is mandatory for all Singaporeans born in 1980 or later. CareShield Life - which offers better and longer payouts than ElderShield which has been around since 2002 - is mandatory for all Singaporeans born in 1980 or later. CareShield Life - which offers better and longer payouts than ElderShield which has been around since 2002 - is mandatory for all Singaporeans born in 1980 or later. Best Careshield Life Supplements In Singapore 2021 Homage. Best Careshield Life Supplements In Singapore 2021 Homage. Best Careshield Life Supplements In Singapore 2021 Homage.

CareShield Life was launched on 1 October 2020 for all Singapore Citizens or Permanent Residents born in 1980 or later. CareShield Life was launched on 1 October 2020 for all Singapore Citizens or Permanent Residents born in 1980 or later. CareShield Life was launched on 1 October 2020 for all Singapore Citizens or Permanent Residents born in 1980 or later. Your Careshield Life premium is 100 payable by Medisave and the premium term is until age 67. Your Careshield Life premium is 100 payable by Medisave and the premium term is until age 67. Your Careshield Life premium is 100 payable by Medisave and the premium term is until age 67. 1 Subsidy rates are applicable to Singapore Citizens who live in residences with an Annual Value AV of 13000 or less. 1 Subsidy rates are applicable to Singapore Citizens who live in residences with an Annual Value AV of 13000 or less. 1 Subsidy rates are applicable to Singapore Citizens who live in residences with an Annual Value AV of 13000 or less.

These cohorts are. These cohorts are. These cohorts are. Additional Premium Support for. Additional Premium Support for. Additional Premium Support for. How to check your ElderShield Coverage. How to check your ElderShield Coverage. How to check your ElderShield Coverage.

Better yet CareShield Life supplements premiums are eligible for MediSave deduction capped at S600 a year. Better yet CareShield Life supplements premiums are eligible for MediSave deduction capped at S600 a year. Better yet CareShield Life supplements premiums are eligible for MediSave deduction capped at S600 a year. More information on the auto-enrolment premiums subsidies and support package will be provided when ready. More information on the auto-enrolment premiums subsidies and support package will be provided when ready. More information on the auto-enrolment premiums subsidies and support package will be provided when ready. The plan offers a monthly payout in the event of severe disability providing basic financial support for long-term. The plan offers a monthly payout in the event of severe disability providing basic financial support for long-term. The plan offers a monthly payout in the event of severe disability providing basic financial support for long-term.

The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime.

If you are searching for Careshield Life Premiums you've reached the perfect location. We have 20 graphics about careshield life premiums adding pictures, photos, photographs, wallpapers, and more. In these webpage, we also have variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Super Mario Tasse Retro 8 Bit Super Mario 8 Bit Mario

Source Image @ www.pinterest.com

Ol2kawt8zt00m

Source Image @

Pin En Imagenes Nuevoydeocasion

Source Image @ www.pinterest.com

Compulsory Careshield Life To Start On Oct 1 For Residents Born In 1980 Or Later Health News Top Stories The Life Activities Of Daily Living Health Check

Source Image @ www.pinterest.com